Sustainability is fundamental to the long-term health of the global economy. It is integral to GIC’s mandate, which is to preserve and enhance the international purchasing power of the reserves under our management.

We believe that companies with strong sustainability practices offer prospects of better returns over the long term, and that this relationship will strengthen over time as market externalities get priced in and incorporated into the decisions of regulators, businesses, and consumers.

We take a holistic and long-term approach towards sustainability across our investment and corporate processes. Investments may entail trade-offs between different sustainability objectives, especially in the short term. GIC integrates sustainability in a way that recognises the diversity of industries and markets in which we operate, and the trade-offs and time needed for companies to make the transition.

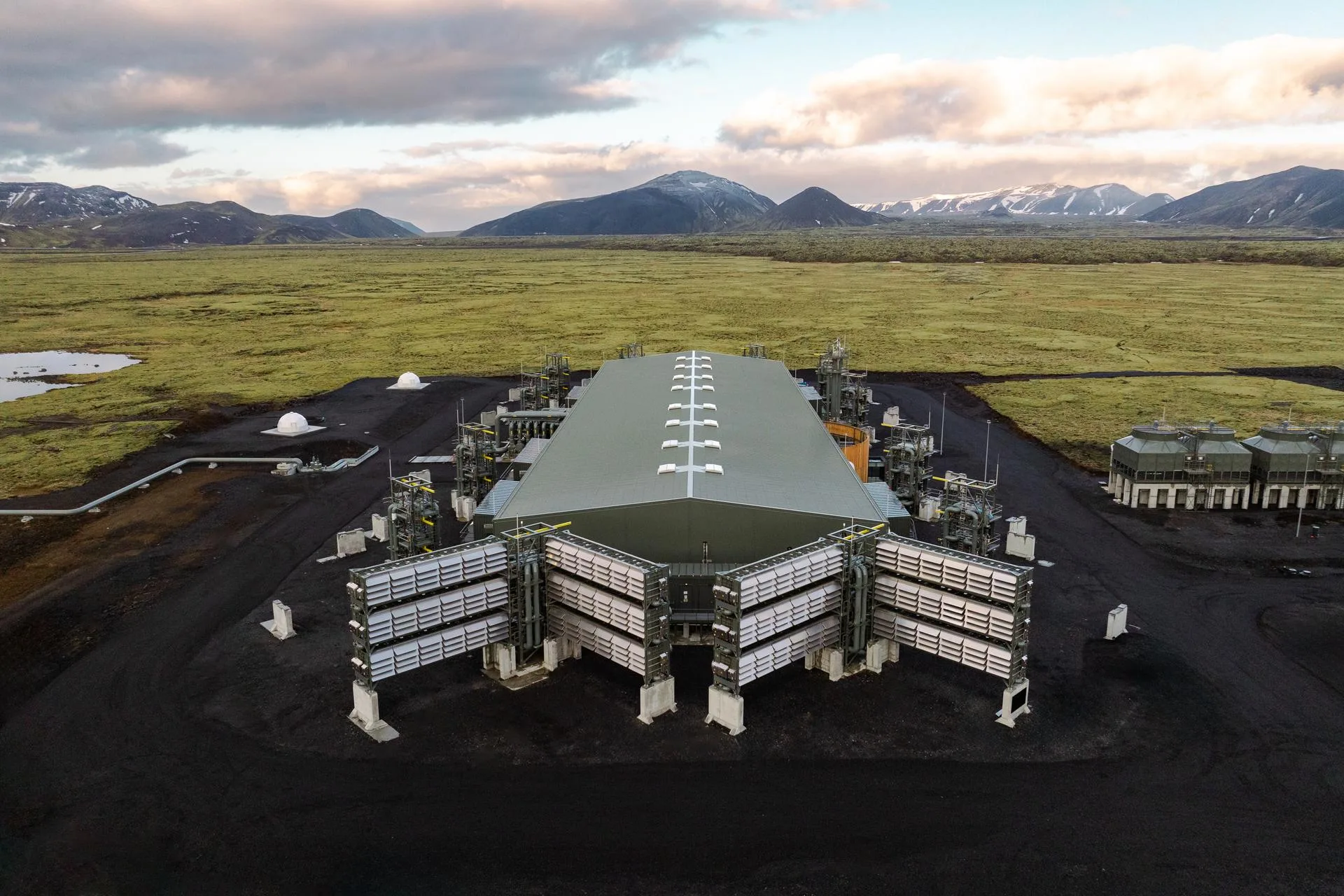

GIC is committed to enabling the global transition to a net-zero economy, through our investments and operations. We believe it is more constructive to support companies in their transition towards long-term sustainability, than to mechanically divest from certain industry sectors. To do this, we have begun to step up active engagements with portfolio companies on their climate transition plans, and fund the adoption and scaling-up of green technologies.